In today’s rapidly evolving digital landscape, the banking industry has undergone a profound transformation. Comprehensive digital solutions have emerged as a key enabler, empowering banks to provide enhanced services, streamline operations, and deliver exceptional customer experiences. At CriticalRiver, we have embarked on a mission to transform and redefine your banking experience in the digital age. Our platform serves as the gateway to a new era of banking, where traditional barriers and cumbersome processes are dismantled to make way for a smoother, more efficient digital experience. By leveraging the power of cutting-edge technologies, we have revolutionized every aspect of banking, ensuring that you have the tools and resources necessary to thrive in the digital realm.

Our Solutions

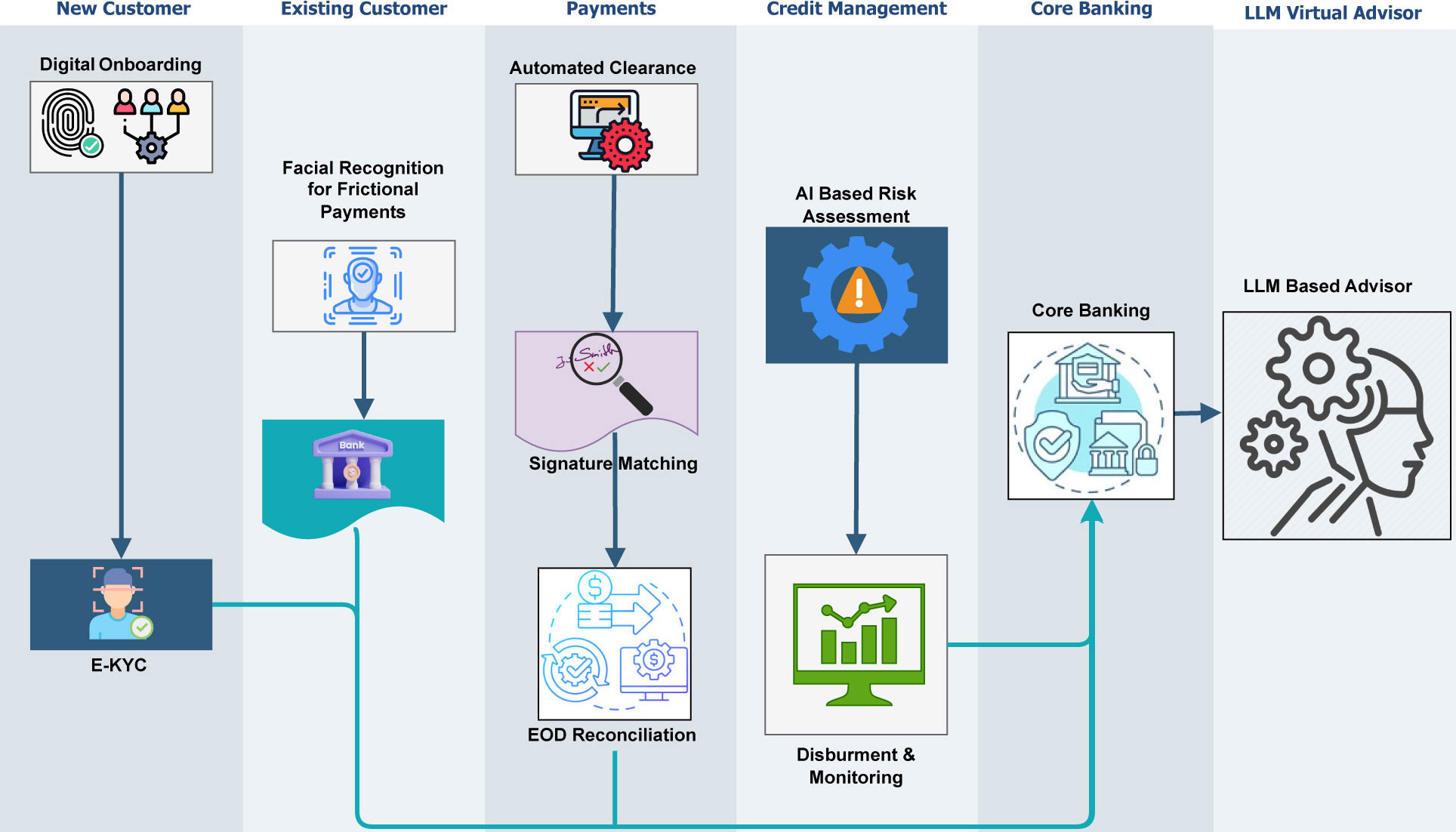

Digital Onboarding

Seamless Onboarding, Secure Identity: Embrace the Future of Banking

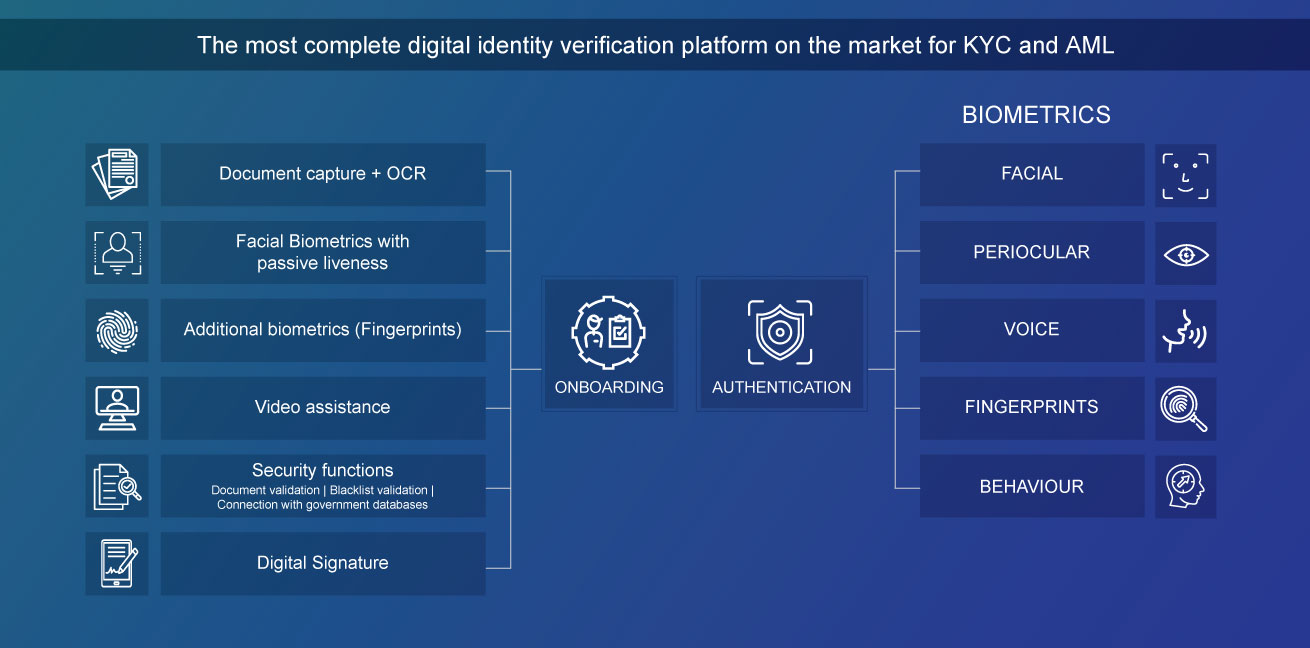

Our platform offers a seamless onboarding process with facial recognition, voice analysis, and fingerprint verification, eliminating paperwork and enhancing speed and accuracy through biometrics, OCR, and machine learning.

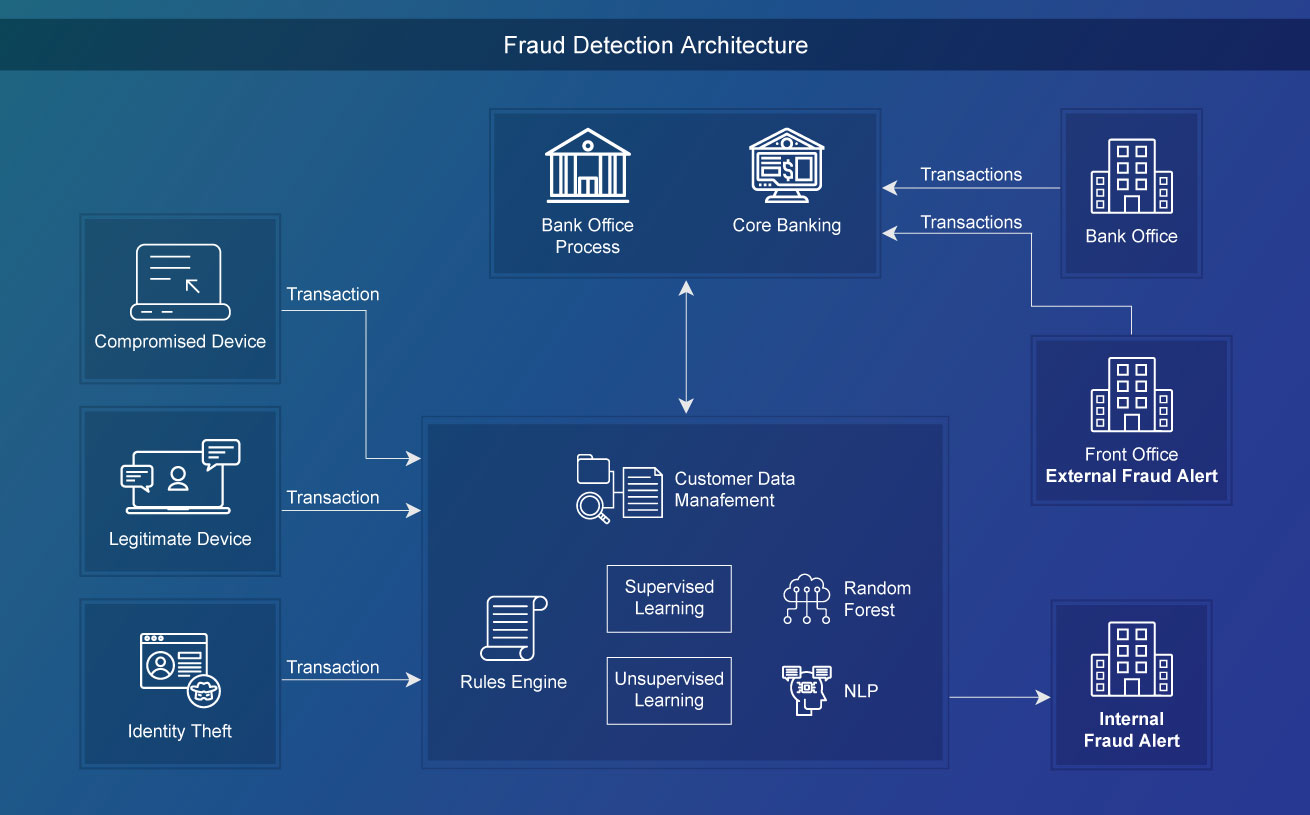

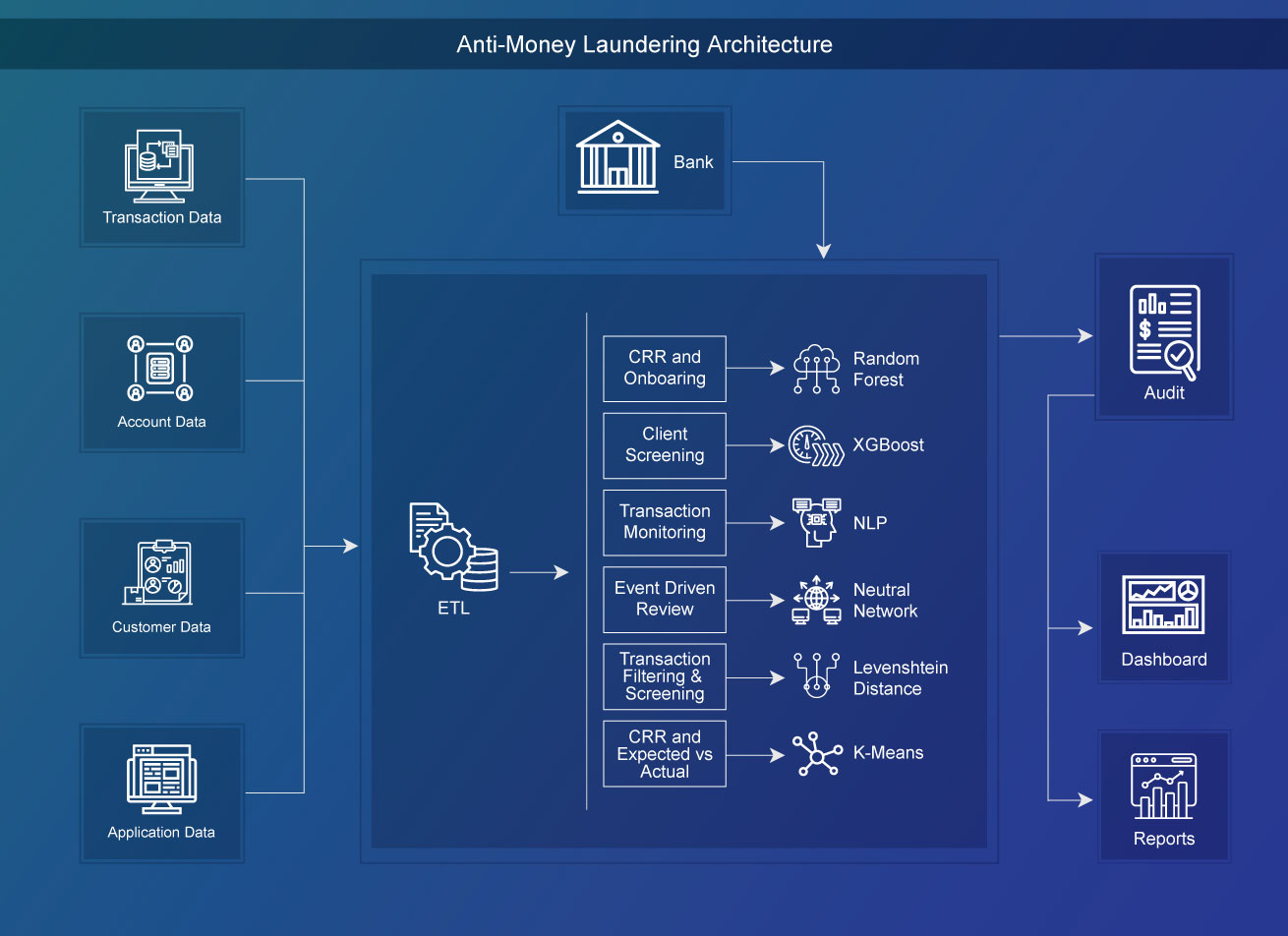

Enhanced Security and Fraud Prevention

Unlocking the Power of AI: Safeguarding Your Finances in Real-Time

Our AI-powered systems employ advanced techniques like Anti-Money Laundering (AML) algorithms to safeguard your finances, detecting and preventing fraud, identity theft, and financial crimes in real-time, providing you with peace of mind.

Personalized Lending and Credit Scoring

Credit Made Personal: Fast, Accurate, and Tailored to Your Needs

We democratize credit with accessible digital platforms, combining alternative data and machine learning for faster, accurate assessments and personalized loan approvals, empowering individuals and businesses to achieve financial aspirations efficiently.

Real-Time Risk Assessment

Stay Ahead of Risks: Real-Time Monitoring for a Secure Banking Experience

Our advanced risk assessment capabilities continuously monitor customer transactions and behavior, enabling proactive measures to safeguard your financial interests. Stay ahead of risks with real-time identification and adaptation of risk scores.

AI-Driven Customer Support

Intelligent Support at Your Fingertips: 24/7 Assistance for All Your Banking Needs

We offer unwavering customer service through chatbots and virtual assistants, providing instant and accurate round-the-clock support. Our AI-driven assistance ensures a smooth and hassle-free banking experience.

Join us on this transformative journey as we embrace the digital revolution in banking. Explore our comprehensive solutions that empower you with enhanced security, personalized lending options, real-time risk assessment, and AI-driven customer support. Discover the future of banking and unlock a world of possibilities with our digitally empowered platform.

Business Drivers

Architectures

Use Cases

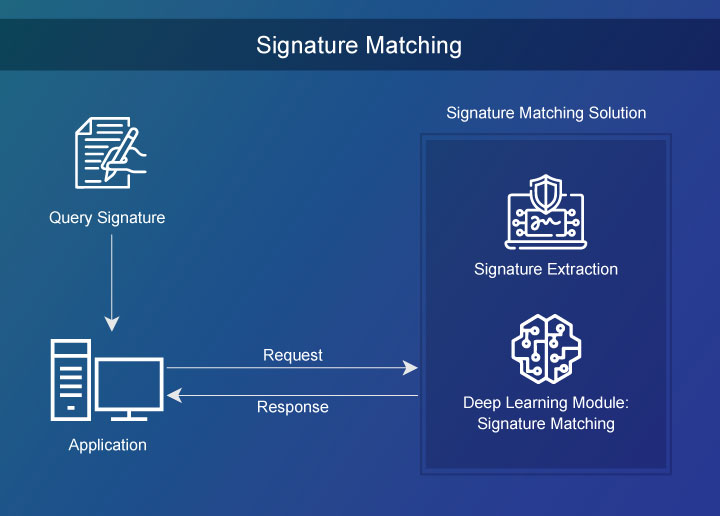

Signature Matching

Problem Statement: Signature matching is a time-consuming and error-prone process when done manually. Organizations need a reliable and efficient method for signature extraction and matching to reduce errors and increase productivity.

Our AI-Based Solution: Signature matching is vital in digital banking onboarding, automating verification for KYC compliance, reducing errors, and enhancing efficiency. It prevents fraud, ensures data accuracy, and enables regulatory adherence. Furthermore, it empowers data analysis for fraud detection and customer insights, optimizing decision-making. Integrating signature matching strengthens digital banking operations, security, and customer trust.

Result: Our solution simplifies the process of signature extraction and matching, reducing the time and effort required to perform these tasks manually. By leveraging AI-based technology, we have increased the accuracy and reliability of signature matching, resulting in better outcomes for organizations.

Machine Learning Models: Yolo8, Auto-encoder for Cleaning, and VGG (Visual Geometry Group) Neural Network for Signature Matching.

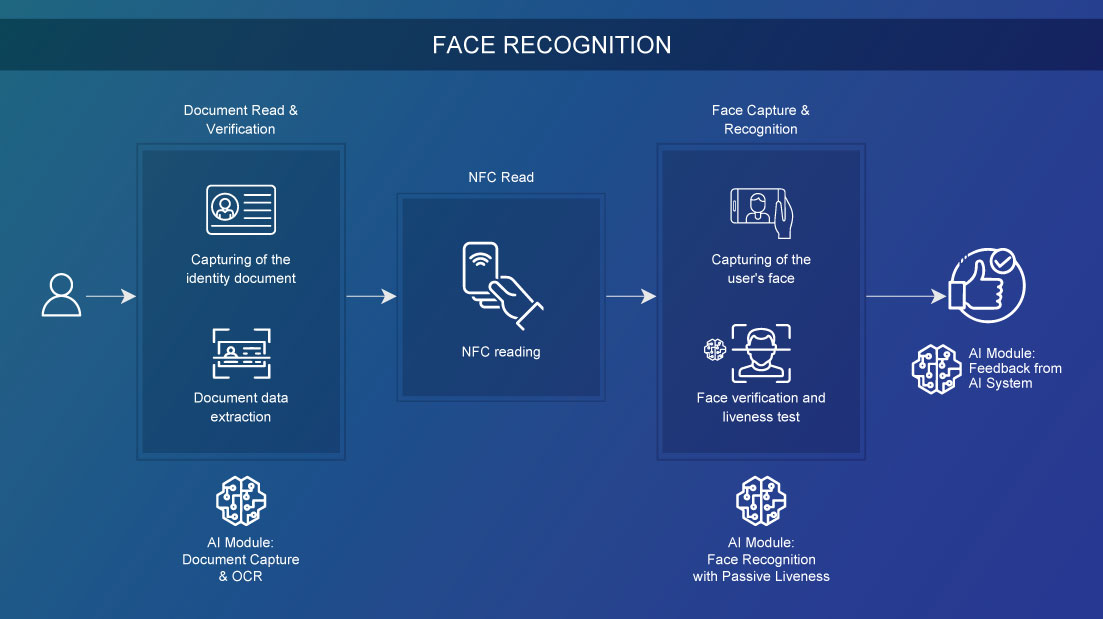

Face Recognition

Problem Statement: Traditional banking processes for account creation, access to the client area, and account handling are often lengthy, cumbersome, and prone to fraud, leading to increased costs and reduced customer satisfaction.

Our AI-Based Solution: CriticalRiver offers a streamlined and secure account creation process with digital onboarding, access to the client area with facial authentication, and account handling with authentication calls. Our technology utilizes AES256 encryption and timestamps to ensure maximum security and reduce fraud to 0. We also provide KYC/AML checks to verify the client’s identity and share it with the relevant authorities.

Result: Our solution has led to significant savings in operating costs, above 50%, while improving customer satisfaction by offering a simple, fast, and intuitive registration process. Additionally, our authentication calls have increased First Call Resolution (FCR) and reduced costs per call. Our technology is available on multiple platforms, including Android, iOS, and the Web, and works on any device.

Machine Learning Models: OpenCV2 Local Binary Patterns Histograms (LBPH) Face Recognizer.

Automated Verification And Validation Of AOF (Account Opening Form) With KYC

Problem Statement: Manual account opening process is time-consuming and prone to errors, making it difficult to extract information from scanned images of different types.

Our AI-Based Solution: CriticalRiver collaborated with its partner to create an AI-powered system that uses Optical Character Recognition (OCR) technology to validate information on KYC documents and match it with data on account opening forms to detect fraud and discrepancies.

Result: Using the AI-powered system, banks can automate their account opening process, reduce manual intervention, save up to 60% in operational expenses, and reinvest the savings into activities that improve their top line. Additionally, the solution helps detect fraudulent activities, improving overall security.

Machine Learning Models: OpenCV2, Local Binary Patterns Histograms (LBPH) Face Recognizer and VGG (Visual Geometry Group) Neural Network for Signature Matching.

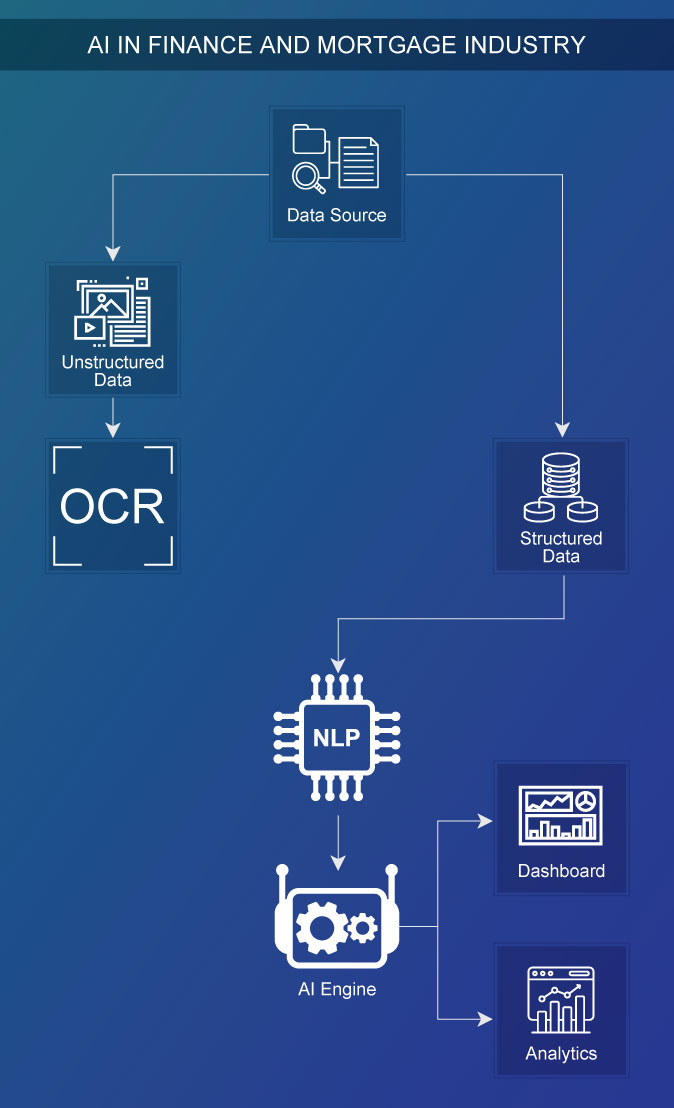

Artificial Intelligence In Finance And Mortgage Industry

Problem Statement: The home buying process involves numerous parties and extensive documentation, making it difficult to fully automate the appraisal process. Extracting information from scanned documents with diverse content and handling the volume of data adds to the complexity.

Our AI-Based Solution: We provide the customer with AI-powered solutions that include:

- Information Extraction: Convert scanned documents into standardized MISMO (Mortgage Industry Standards Maintenance Organization) XML format, extracting 1080 distinct data elements from various sources.

- Data Harmonization and Normalization: Utilize AI and NLP algorithms to harmonize and normalize data from different sources for accurate record mapping and analysis.

- AI Risk Score Prediction: Replace 700+ handcrafted rules with a neural network-based AI model to predict risk scores using appraisal data.

- AI Loan Payment Status Prediction: Develop a deep learning model using 4.5 billion loan records to predict home loan payment statuses throughout the loan’s life.

Result: With AI, the company now offers a fully automated solution for banking and mortgage clients, reducing risks and costs.

Machine Learning Models: Camelot & PyPDF2 extract the data from pdf and ANN (Artificial Neural Network), XGB (Extreme Gradient Boosting) classifier for prediction.

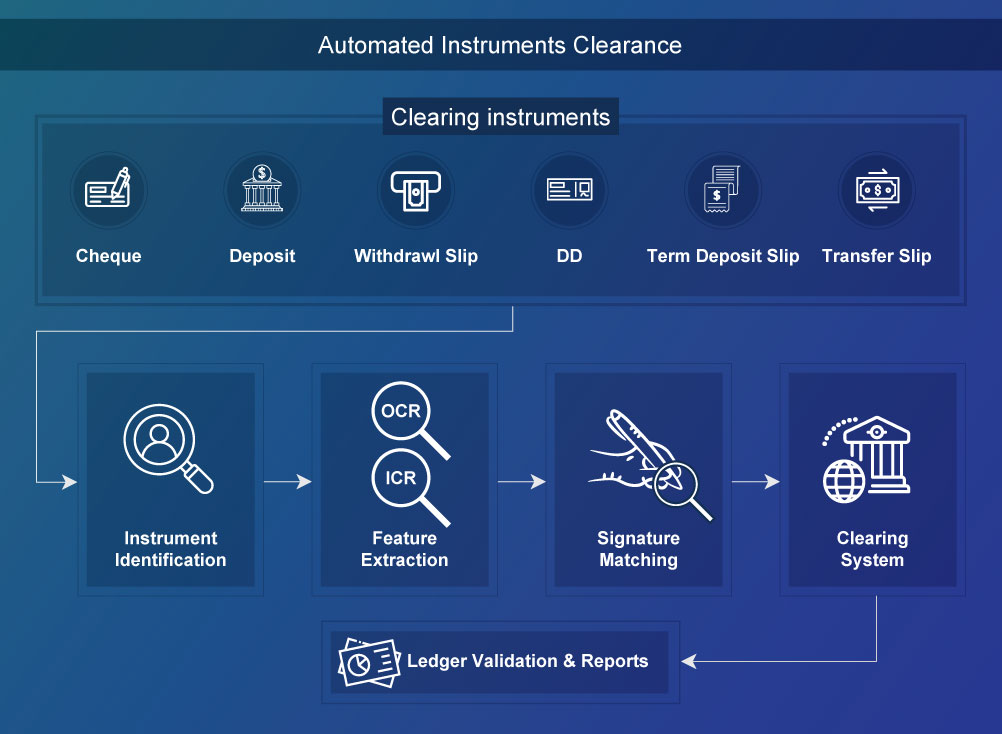

Automated Instruments Clearance

Problem Statement: A certain financial institution faces the challenge of processing a significant number of handwritten banking instruments daily, which necessitates a sizable workforce, posing a challenge to automation efforts.

Our AI-Based Solution: The financial institution employs AI to automate the back-office operations, including clearing all banking instruments and reconciling with the general ledger. The solution uses Optical Character Recognition (OCR)/Intelligent Character Recognition (ICR) technology to extract information from scanned images and validate them with the core banking system, reducing manual effort by 30-40%. The financial institution also tracks the progress using data analytics and KPIs.

Result: The implementation of AI has saved banks almost 50% of their operational expenditure, allowing them to invest in improving their top line.

Machine Learning Models: Pytesseract for MICR (Magnetic Ink Character Recognition) Code extraction from cheque and CNN (Convolutional Neural Network) for Handwriting Extraction & Classification.

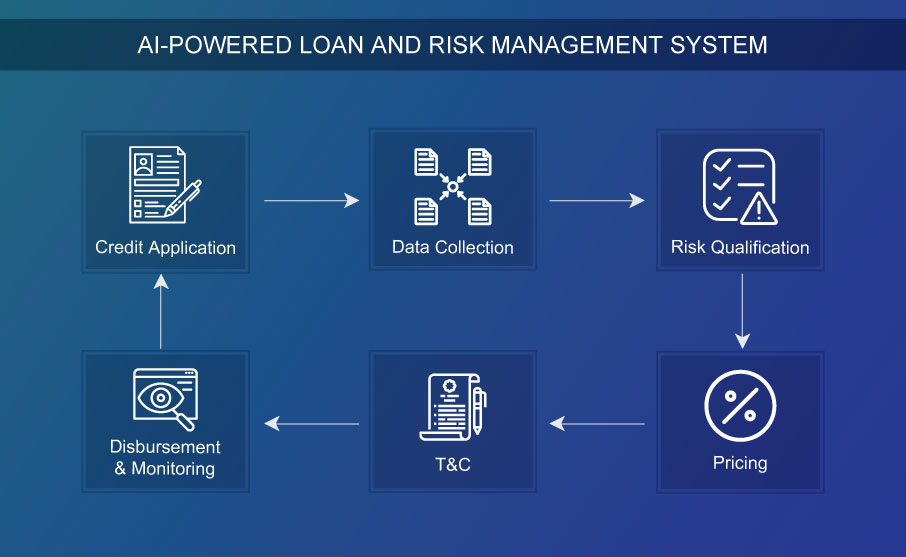

AI-powered Loan And Risk Management System

Problem Statement: Banks and mortgages are exposed to high risk of loan defaults and NPA’s and initial risk assessment prior to loan sanction due to changing fraud tactics.

Our Solution Based on AI: We offer AI-powered solutions that analyze various customer-related data and detect customers who are likely to fall into a debt trap. The system also has built-in algorithms for Loan Surveillance Risk Assessment for all types of Loans. The system can monitor customer behavior in real-time and flag any unusual patterns or trends indicating potential risk and provide a comprehensive risk management system for loan portfolios, including automated risk assessment and early alerts for potential issues.

Result: Our AI-powered solutions have helped banking and mortgage clients identify high-risk customers, thus allowing taking required mitigations before sanctioning loans the system also addresses risks, reduces costs, and improves overall performance. This solution offers a self-serve platform for identifying potential risks, and risk assessment, while the Risk Monitoring System generates early alerts to prevent Non-Performing Assets. The system can also help banks maintain a healthy loan portfolio and reduce their overall risk exposure.

Machine Learning Models: Random Forest for prediction.

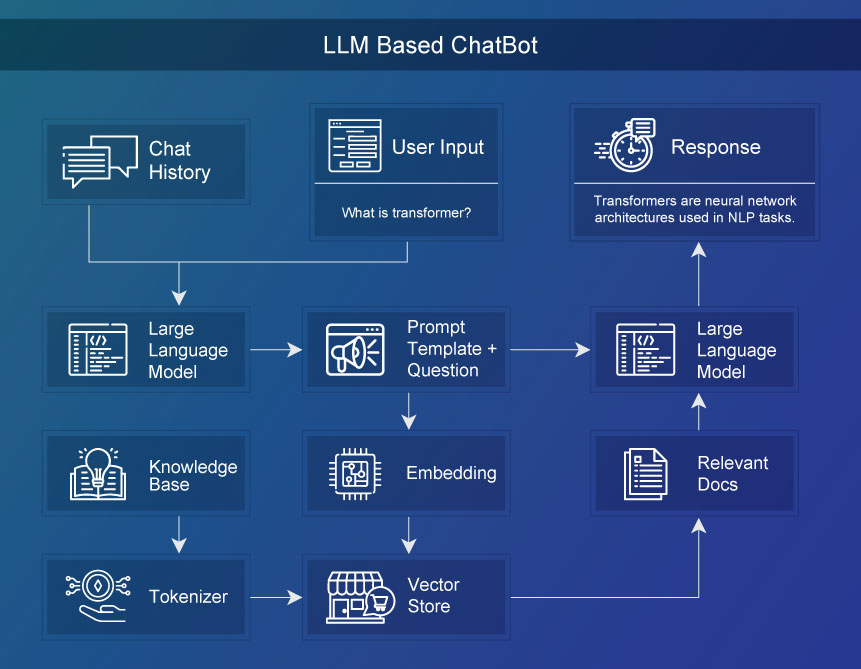

Large Language Models AI-powered Chatbots

Problem Statement: Existing chatbots struggle to provide accurate responses and human-like interactions. Large Language Models (LLMs) can improve customer experience and increase efficiency. Developing AI chatbots powered by LLMs is a challenging task for many businesses. The problem statement is to create a scalable framework for building effective AI chatbots to enhance business operations and user engagement.

Our Solution Based on AI: Introducing LLM-powered chatbots – the ultimate solution for businesses looking to provide exceptional customer experience and increase efficiency. With our cutting-edge framework, businesses can easily build chatbots that can effectively understand and respond to customer queries in a conversational and engaging manner, powered by the latest advancements in Large Language Models. Our LLM-powered chatbots can provide personalized recommendations, answer complex questions, and even perform transactions, all while providing a human-like experience that customers will love.

With our solution, businesses can reduce response times, improve customer satisfaction, and enhance their overall operations. Say goodbye to clunky chatbots and hello to LLM-powered chatbots – the future of customer interactions.

Machine Learning Models: Gpt4all-j/Llama-cpp.

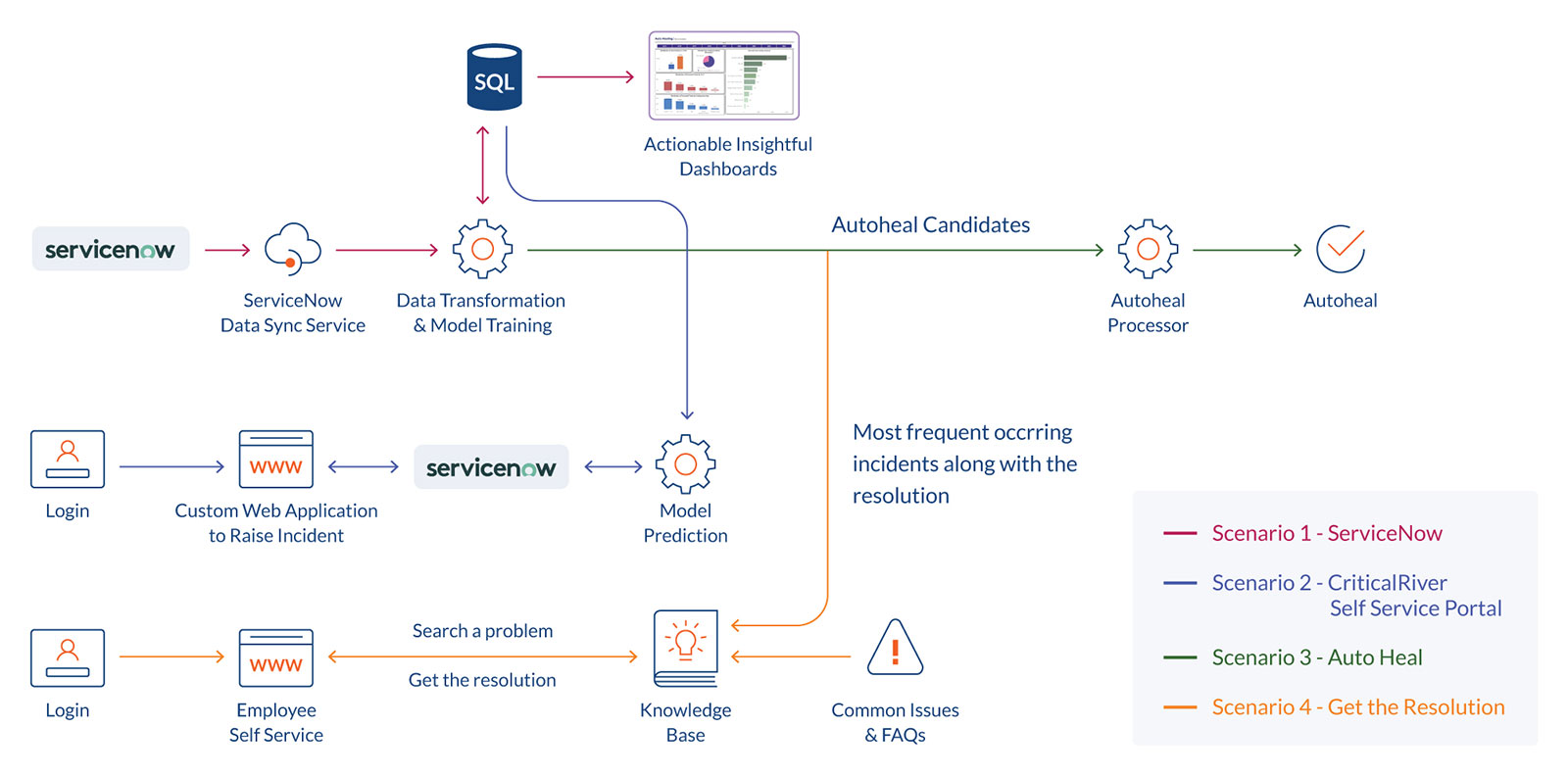

Predictive Digital It Operations And Incident Auto Healing

Problem Statement: Challenged by the need for quick incident data analysis and KPI reporting, an American network test, measurement, and assurance technology company turned to CriticalRiver for an AI-powered solution.

Our Solution Based on AI: CriticalRiver’s AI/ML solution automates data analysis and reporting, providing insightful dashboards for quick access to incident data and KPIs. It streamlines incident categorization, reduces false alarms, predicts upcoming events, and enhances security through advanced machine-learning techniques. Overall, it improves incident management and reduces manual effort for root cause analysis.

Result: Detailed reports and insightful dashboards that empowered the customer to make informed decisions, and a streamlined process that impressed even the most demanding CxOs.

Machine Learning Models: XGB (Extreme Gradient Boosting), Random Forest, and NLP (Natural Language Processing).

Our Differentiators

Current Trusted

Client Base

We understand the client’s current processes and the opportunities for improvement.

Improved Accuracy

and Speed

We offer end-to-end pre-packaged models and data pipeline templates (MLOps) to jumpstart the process.

Enhanced Data Processing Capabilities

We have a 12-step data cleansing and transformation IP accelerator with machine learning algorithms.

Our Strategic AI/ML Partnerships and Past Fortune 500 Experience

Our partners have helped a lot of organizations, and our team has learned from past experiences.

Overcoming the Data & Technical Debt Challenge

Discover more about CriticalRiver’s powerful solution, which enables businesses to unlock the full potential of their data, providing valuable insights, and improving predictive models.

Enhanced data processing capabilities: 12-step data cleansing & transformation accelerator with Machine Learning algorithms.

Improved accuracy and speed: End-to-End pre-packaged (MLOps) models and data pipeline templates.

Data Privacy: Our Federated Machine Learning (FML) expertise helps with data privacy, enhanced scalability, and reduced data transfer. FML enables organizations to train machine learning models without the need to move sensitive data outside of their secure environments, thereby reducing the risk of data breaches and cyberattacks.

Reduced costs and increased productivity: By automating data processing and model

training, companies can significantly reduce the time and resources needed for data management. This frees up personnel to focus on other important tasks and can lead to a significant reduction in costs associated with data processing and model development. Refer to this article, for more details.

“ 12-step data cleansing & transformation accelerator with Machine Learning algorithms ”

Insights

Our thinking on ideas, technology, and trends that create impact

Tools/Platforms Expertise

-

Azure DevOps

-

Azure Repos

-

Azure Pipelines

-

Azure Boards

-

Azure Test Plans

-

Jenkins

-

Docker

-

Kubernetes

-

Grafana

-

Prometheus

-

Microsoft Azure

-

Google Cloud Platform

-

Amazon Web Services

-

Splunk

-

Python

-

Bitbucket

-

GitHub

-

GitLab

-

Vagrant

-

Selenium

-

Terraform

-

Ansible

-

TensorFlow

-

SNYK

-

Aqua Sec

What Is Next (Where the World Is Heading) In AI-Enabled Operations?

And how are we preparing proactively?

Cloud Agnostic Plug & Play Packages

Portable, pre-configured AI/ML models that can be easily deployed across different cloud (AWS/Azure) platforms, enabling seamless integration, flexibility, and efficient resource utilization.

Generative AI with ChatGPT Knowledge Portal & Chatbots

Easily and quickly get insights from all the organization’s structured and unstructured data.

Federated Machine Learning

Enables decentralized data training across multiple devices or servers, preserving privacy and reducing data transmission overhead.

Let’s Start Something New

You can also email us directly at contact@criticalriver.com