Uncovering the Hidden Patterns in Your Financial Data

FinCoPilot has been built to address real-world problems that finance teams face every day.

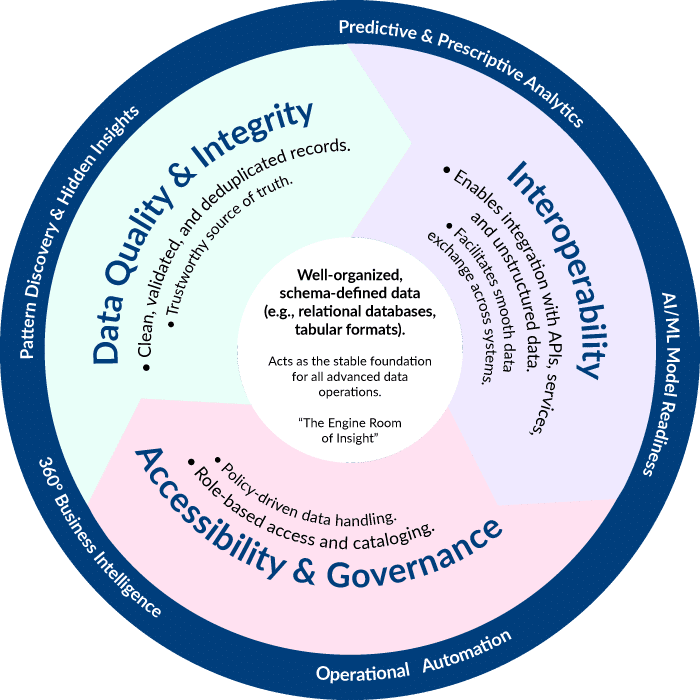

Data Quality & Integrity

- Clean, validated, and deduplicated records.

- Trustworthy source of truth.

Interoperability

- Enables integration with APIs, services, and unstructured data.

- Facilitates smooth data exchange across systems.

Accessibility & Governance

- Role-based access and cataloging.

- Policy-driven data handling.

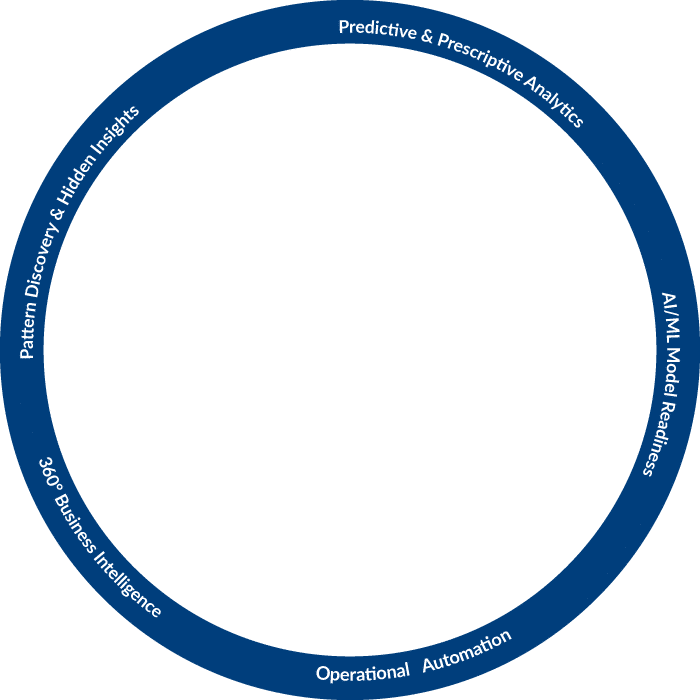

Emerging Possibilities

Unlock the full power of your data with advanced capabilities like AI model readiness, predictive analytics, and 360° business intelligence—built on a foundation of structured, interoperable data.

Use Cases

Real-World Use Cases: FinCoPilot in Action

FinCoPilot delivers measurable impact across critical finance operations—streamlining workflows, reducing manual effort, and empowering teams with intelligent automation.

Close the Books Faster

Challenge: Time and effort spent extracting, normalizing, and reconciling data delays month-end close.

FinCoPilot Advantage: Seamlessly collates data from multiple systems and automates repetitive close activities—shrinking close cycles and freeing up finance teams.

Cut Finance Ticket Volumes

Challenge: High volume of service desk requests for invoice or payment status.

FinCoPilot Advantage: Natural language queries let non-technical users self-serve answers instantly—reducing tickets and improving employee satisfaction.

Smarter License Utilization

Challenge: Overuse of costly read-only application licenses for basic reporting.

FinCoPilot Advantage: Built-in analytics and querying tools provide broad access to finance insights—without additional license overhead.

Faster, Flexible Reporting Across Teams

Challenge: ERP report customization requires IT and cross-team coordination.

FinCoPilot Advantage: Finance users can instantly generate custom reports using natural-language prompts—no IT ticket needed.

Unified Financial Visibility

Challenge: Fragmented data makes it hard to drill down into financials across entities.

FinCoPilot Advantage: View, compare, and explore consolidated reports with full drill-down—bringing clarity to every transaction.

Minimize Errors with Intelligent Automation

Challenge: Repetitive, data-heavy workflows increase error risk.

FinCoPilot Advantage: Continuous data testing and intelligent automation reduce risk and surface anomalies before they escalate.

Architecture

Robust Architecture for Smarter Finance

Built for scale, trust, and transparency—FinCoPilot’s architecture ensures secure, compliant, and explainable AI across your financial workflows.

Accounting Common Domain Model (CDM)

FinCoPilot’s decisions are rooted in an integrated, pre-packaged accounting data model—delivering accuracy, explainability, and confidence in every output.

Explainable AI

Results are accompanied by transparent rationale, enabling finance teams to understand and trust recommendations.

Compliance-Centric Design

Built-in safeguards align with financial regulations, helping organizations meet internal and external compliance standards.

Agent + Tool Architecture

Combines powerful AI Agents with execution tools, delivering a scalable and composable system tailored to enterprise needs.

Cloud-Native & Extensible

Easily integrates with your existing ERPs, HRMS, and data sources via secure APIs—no need to replace legacy systems.

Performance at Scale

Analyze hundreds of thousands of records without compromising speed or stability.

Security

Secured by Design: FinCoPilot’s Enterprise-Ready Architecture

Finance leaders need more than insights—they need assurance. FinCoPilot is built with enterprise-grade security and governance at its core, delivering trusted AI intelligence without compromise.

Your Cloud. Your Control.

Hosted on Your Infrastructure

FinCoPilot runs entirely within your organization’s cloud environment—giving you full control over data residency, governance, and compliance.

Minimize Exposure, Maximize Trust

Minimal Data Exposure to LLMs

Sensitive financial data is never indiscriminately shared with language models. FinCoPilot uses secure, narrow-scope prompts to ensure data privacy and regulatory alignment.

Secure Access to What Matters

Encrypted & Authorized Data Retrieval

Data is retrieved through secure APIs, governed by policy-enforced access rights—ensuring only approved users and agents can access what they need.

Granular Access, Defined by You

Role & Attribute-Based Access Control (RBAC + ABAC)

Set access rules by roles, departments, or user attributes—so finance teams get what they need, and nothing more.

Guardrails That Keep You Safe

AI Guardrails Built-In

FinCoPilot integrates safety mechanisms at every interaction—from prompt validation to output constraints—ensuring responsible AI use that aligns with enterprise policies.

Full Transparency, Always

Governance & Auditability

Every query, action, and output is logged and traceable. FinCoPilot offers end-to-end auditability to support compliance, investigations, and internal controls.

Why FinCoPilot Matters

Transforming Your Finance Operations

CFOs Gain Vision, Not Just Data

Less time is spent correcting errors and more time fueling growth and strategic decisions.

Unified, Trustworthy Data

Seamless data flow drives clearer, more reliable forecasts boosting confidence.

Proven ROI

Measurable ROI through reduced opex, enhanced productivity, and reliable financial forecasts.

Future-Ready Finance

Empower your finance teams with modern, secure technology that drives efficiency and innovation.

Why Businesses Choose Us

The CriticalRiver Edge

At CriticalRiver, we empower your business to thrive with the right technology.

Ready to Discover the Hidden Patterns in Your Financial Data?

Contact us today to discover how FinCoPilot can bring clarity to your data, revealing the insights that will drive smarter, faster decisions.

FAQ’s

Frequently Asked Questions (FAQs)

1. How does FinCoPilot handle disconnected systems that delay insight generation?

FinCoPilot’s AI Agents automatically collect and process data from multiple sources, surfacing critical financial metrics in real time—eliminating delays caused by disconnected systems.

2. What if my finance team lacks the technical skills to work with data?

No problem—FinCoPilot features intuitive, natural-language prompts that allow any team member to interact with data securely, without writing a single line of code.

3. Can FinCoPilot help manage cash flow volatility?

Yes. It includes built-in forecasting tools that provide early alerts, helping finance teams proactively manage liquidity and capital planning.

4. How does FinCoPilot address data silos?

With OmniSync, FinCoPilot consolidates data streams into a single, unified view—eliminating inefficiencies and offering full visibility across systems.

5. Can FinCoPilot automate manual reconciliations?

Absolutely. FinCoPilot uses AI-driven reconciliation tools to instantly match statements and invoices—saving time and freeing up finance teams for strategic work.

6. How does it improve reporting accuracy and consistency?

FinCoPilot ensures real-time data accuracy and consistent reporting formats across platforms with a centralized data platform.

7. What makes FinCoPilot different when it comes to utilizing vast data sets?

It transforms financial data into actionable insights, empowering finance teams to become strategic advisors and align decisions with enterprise goals.

8. Can it automate repetitive accounting tasks?

Yes. FinCoPilot uses reusable data templates to automate repetitive workflows—so you build once and run many times with minimal effort.

9. Is it scalable enough for enterprise-level data analytics?

FinCoPilot is designed to analyze up to 500,000 records efficiently delivering fast, scalable insights across large data volumes.

10. How trustworthy are FinCoPilot’s AI-driven recommendations?

FinCoPilot is powered by an Accounting Common Domain Model (CDM), ensuring accuracy, explainability, and full compliance with financial regulations.

11. Will all team members have a consistent experience using FinCoPilot?

Yes. Its conversational interface offers a unified experience across roles—from analysts to CFOs—without requiring BI or technical expertise.

Let’s Start Something New

You can also email us directly at contact@criticalriver.com