- CR AI(x)

- Studios

-

-

The Investigator

Ready-to-deploy agentic solutions for enterprise impact.

Services

Salesforce Empowers finance leaders with predictive visibility,

intelligent forecasting, and autonomous control.ERP Drives proactive issue detection, self-healing operations, and AI-powered service management.

Digital Transformation Drives proactive issue detection, self-healing operations, and AI-powered service management.

Cloud Empowers finance leaders with predictive visibility,

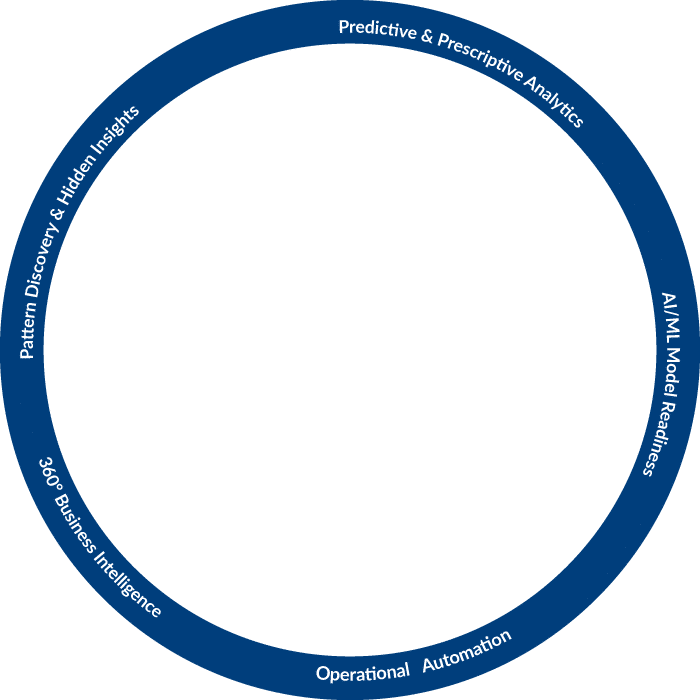

intelligent forecasting, and autonomous control.Data and Analytics Drives proactive issue detection, self-healing operations, and AI-powered service management.

AI Drives proactive issue detection, self-healing operations, and AI-powered service management.

-

What's new

Activate complimentary assessments, explore benchmark insights, and experience the future of enterprise AI.

-

-

- Solutions

-

-

The Imagineer

AI-engineered innovations that shape what’s next.

-

What's new

Activate complimentary assessments, explore benchmark insights, and experience the future of enterprise AI.

-

-

- Platforms

-

-

The Builder

AI-native platforms that unify, automate, and accelerate decisions across the enterprise.

-

What's new

Activate complimentary assessments, explore benchmark insights, and experience the future of enterprise AI.

-

-

- Industries

-

-

Transforming Industries with Measurable Outcomes

AI-first innovation that accelerates outcomes and maximizes ROI across industries.

Industries

Hi-Tech Empowering innovation with AI-driven automation, data intelligence, and platform scalability.

Energy & Utilities Driving sustainability and operational efficiency through predictive analytics and intelligent automation.

Banking/Finance Modernizing financial operations with secure, explainable AI and intelligent automation for faster insights.

- Healthcare Enabling connected, compliant, and patient-centric ecosystems powered by AI and data trust.

- Manufacturing Optimizing production, quality, and supply chains with real-time visibility and AI-led decisioning.

- Non-Profit Accelerating impact through data-driven insights, automation, and transparent operations.

-

What's new

Activate complimentary assessments, explore benchmark insights, and experience the future of enterprise AI.

-

-

- Customer Success

-

-

Stories of Success That Inspire Confidence

Proven Impact. Real Partnerships. Measurable Outcomes.

-

What's new

Activate complimentary assessments, explore benchmark insights, and experience the future of enterprise AI.

-

-

- About

-

-

Discover the People and Purpose Behind CriticalRiver

Learn more about our leadership, values, and vision that drive transformation through innovation, integrity, and impact.

About Us

-

What's new

Activate complimentary assessments, explore benchmark insights, and experience the future of enterprise AI.

-

-